Electronic Invoices Business to Business

Europe

Electronic invoicing is mandatory in Italy, which introduced mandatory e-invoices on January 1st, 2019. Apparently, and potentially because of less fraud, in 2019 their VAT income was 3% higher than 2018. Additionally, B2B e-invoicing will become mandatory in France in 2027 and in Germany in 2027/2028 for B2B invoices.

A 2022 initiative of the european parlaments, recommended a standard for cross-border B2B E-invoices (Recommendation C1), but that does not say if anybody should be oblidged to send/receive B2B E-invoices. In December 2022 they detailled on more comprehensive plans to reform VAT in an initiative “VAT in the Digital Age” abbreviated ViDA, introduce a european CTC and on regulations on cross border e-invoices.

In Austria, e-invoices are more or less treated like digital versions of the printed invoices, which makes it very easy to handle with. Austrian companies might even be allowed to destroy paper receipts after scans.

In Hungary, apparently e-invoices have to be digitally signed. Poland and Greece however, seem to consider mandatory B2B-e-invoices for “Entrepreneurs”.

Regarding Switzerland, in 2018 Simone Sporing held a (german) speech “Die E-Rechnung in Industrie und Handel” how Coop introduced ZUGFeRD and that and how it was certified by the authorities

For further details on all European countries please refer to the 4th (2020) “EU compendium on e-invoicing retention” which also lists the legal requirements for the different countries, the e-Invoicing country factsheets or the (german) collection on legal foundations for electronic invoices in the EU (Sammlung der Rechtsgrundlagen für elektronische Rechnungen in der EG).

France

France introduces mandatory B2B e-invoices

The APIs are run on French Government’s API management, called PISTE, in particular the tax services part, AIFE. One can register for a trial access to Chorus Pro with french Siren number or e.g. german VAT ID to have test credentials created which can be used on the trial access of the AIFE (documentation).

France has communicated this internationally, e.g. on February 10th 2022 in the “The French Presidency’s ministerial conference on e-invoicing: Electronic invoicing: an instrument for the digital transformation of businesses & government”

as well as domestrically e.g. on March 14th, 2023

Germany

In 2024 the Growth Opportunities Act Wachstumschancengesetz was passed which, on it’s pages 60ff, changed VAT legislation (the Umsatzsteuergesetz) which initiated the introduction of domestic B2B e-invoices with three formats (UBL, CII and ZUGFeRD/Factur-X) in the three phases reading (as of 2025), writing (2027 for big and 2028 for small companies) and CTC (not yet defined). It is mentioned that this predates, and is supposed to be compatible to, the European CTC envisioned in the ViDA draft guideline.

Additionally, the german GOBD impose some obligations if you “save” an invoice in „the file-system“ – or if you accept (i.e. pay) structured or unstructured electronic invoices.

Among the most important duties is that both sender and recipient have to electronically archive the document (and potential embedded XML) in an unalterable way (“revisionssicher”), which requires (among others) tamper-free storage and a documentation of the process. BITKOMs has summarized the 10 most important requirements (german) and also published a exhaustive list of requirements vis á vis document management systems (in german).

On Youtube you will find a 20 minute german speech from 2016 on electronic invoices for SME.

With a 10 minute (still german) update in 2019.

In general, scanned paper invoices may be disposed, but only after certain criteria are met: e.g. it is defined who is responsible for that particular scan, the according person checked that its complete and legible, and the first digital backup has been created.

There is a (german) sample documentation on how to scan and how to file (also german). The DATEV has confirmed (in german) that digital files can be legally compliant.

In Germany there is no legal requirement to ask the recipient for permission to send her electronic invoices, if the invoice is accepted and paid, it means the the recipient also complies to the additional regulations. It is, however, her right to reject the electronic version and explicitly ask for a paper copy. In this case the paper original has to be provided.

After a (german) paper how the italian approach could also be applied on Germany the Federal Audit Office (Bundesrechnungshof) mentioned it, the Scientific Service of the Bundestag investigated and a political party requested mandatory B2B invoicing in Germany. In the 2021 coalition treaty to form the newly elected German government the parties agree to at least introduce a Continuous Transaction Control system (CTC) on the basis of individual invoices “We will introduce an electronic reporting system as quickly as possible on a uniform basis throughout Germany, which will be used for the creation, verification and forwarding of invoices. In this way, we will significantly reduce the susceptibility of our VAT system to fraud and at the same time modernize and reduce bureaucracy in the interface between the administration and businesses.” (“Wir werden schnellstmöglich ein elektronisches Meldesystem bundesweit einheitlich einführen, das für die Erstellung, Prüfung und Weiterleitung von Rechnungen verwendet wird. So senken wir die Betrugsanfälligkeit unseres Mehrwertsteuersystems erheblich und modernisieren und entbürokratisieren gleichzeitig die Schnittstelle zwischen der Verwaltung und den Betrieben.”). In November 2022 Germany asked the EU for permission to introduce domestic mandatory e-invoices and as of 18 April 2023 a discussion paper was circulated if that was possible to January 1st, 2025 ((german) source). This seems ambitious given the fact that today, in April 2023, not even the number of invoices is recorded, let alone their content.

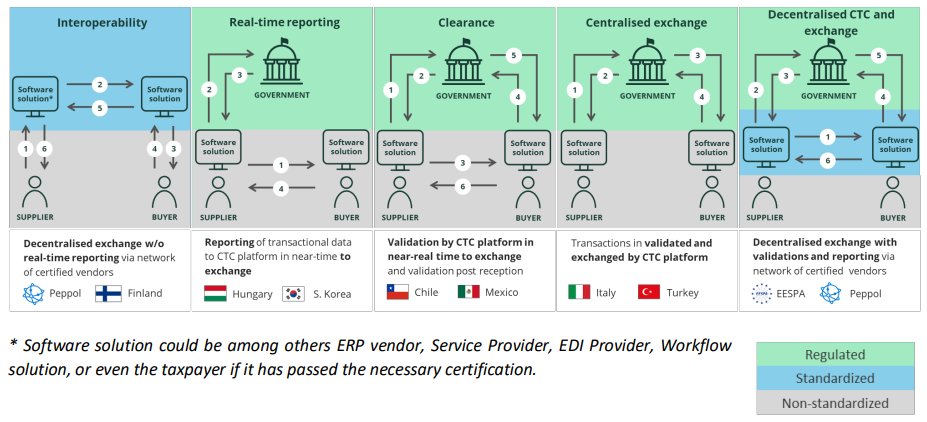

Alexander Kollmann et al. described possible CTC models,  and mention a rather limited effort to implement a model similar to France’s using Peppol: The french model is the right one in the diagram on their page 6, with the difference that also the government issues invoices.

and mention a rather limited effort to implement a model similar to France’s using Peppol: The french model is the right one in the diagram on their page 6, with the difference that also the government issues invoices.